Mining is a capital-intensive game. When metal prices fluctuate, the pressure to reduce Capital Expenditure (CapEx) becomes immense. You are likely facing a familiar dilemma: you need to expand your haulage fleet to hit production targets, but the lead times for a new Caterpillar AD22 or a Sandvik TH320 are stretching anywhere from 8 to 14 months. Plus, the price tag is heavy enough to hurt your cash flow for the next three quarters.

This is where the alternative comes in. You have seen the brochures and heard the rumors about Chinese underground mining trucks offering the exact same capacity for half the price. But the hesitation is real. Can a machine that costs 50% less actually survive the brutal conditions of a hard rock decline? Or will it become a pile of scrap metal in six months?

This article strips away the marketing noise. We will look strictly at the engineering, the supply chain, and the math to see if the savings are real or just a trap.

The Price Gap: Where Does the Money Go?

To make an informed decision, you first need to look at why the price difference exists. It is not just about labor costs; it is about the business model.

When you buy from giants like Epiroc or Caterpillar, you are paying for massive global corporate overheads, proprietary software development, and a tiered dealership network that adds margin at every step of the logistics chain. The machine is excellent, but you are paying a premium for the logo on the side.

In contrast, mining equipment manufacturers in china operate on a factory-direct model. They rely on established industrial clusters—where steel, fabrication, and assembly happen within a tight radius—to slash logistics and overhead costs. They don’t spend millions on Super Bowl ads or fancy regional headquarters. This efficiency allows them to price their equipment based on the sum of its parts, rather than the perceived value of its brand.

The “Guts” of the Machine: A Head-to-Head Comparison

The biggest fear most buyers have is that “cheaper” means “inferior parts.” This is where the story gets interesting. If you open up the panels of a modern Chinese truck, you often find the exact same components used in Western machines.

Let’s stop talking in generalities and look at the hard specs. We will stack the ZONGDA 20-Ton Underground Truck directly against the industry standards in the 20-tonne class (like the Sandvik TH320 or Epiroc MT2010).

| Specification | Premium Brand (20T Class) | ZONGDA ZDT20 (20T) | The Verdict |

|---|---|---|---|

| Engine | Volvo / Cat C-Series | Deutz F12L413FW (Air-cooled) or Volvo TAD853VE | You get the choice: Robust German air-cooled or modern Volvo power. |

| Transmission | DANA 6000 Series | DANA R36000 | Identical Supplier. The R36000 is a heavy-duty global standard. |

| Torque Converter | DANA C Series | DANA C5000 | Identical Supplier. Proven efficiency. |

| Axles | Kessler / DANA | KESSLER (Germany) | Identical Supplier. These are the best axles in the industry. |

| Payload | 20,000 kg | 20,000 kg (10m³ Bucket) | Direct Match. |

| Dimensions | Approx. 9m x 2.3m | 9050mm x 2280mm | Fits standard 4.5m x 4.5m headings perfectly. |

Look closely at that table. The ZONGDA truck isn’t using “knock-off” parts. It is driven by Germany’s Kessler axles and a DANA R36000 transmission. These are the exact same powertrain components you find in machines that cost double the price. The standard Deutz F12L413FW engine is legendary in underground mining for its air-cooled simplicity—no radiators to clog or leak in the hot, dusty depths.

You are effectively getting a European powertrain wrapped in a cost-effective chassis built by mining equipment manufacturers in china.

Reliability & Maintenance: The “Simplicity” Advantage

There is a downside to the technological advancement of premium brands: over-engineering.

A modern Caterpillar or Epiroc truck is a marvel of technology. It has sensors for everything. But in a remote mine in Africa or South America, a sensor failure can be a disaster. If the ECU detects a fault, it might put the truck into “limp mode,” requiring a certified technician with a specific laptop and software license to unlock it.

Chinese equipment tends to favor mechanical simplicity. If a gauge fails on a ZONGDA truck, the truck keeps running. The hydraulic systems are pilot-controlled rather than electro-hydraulic, meaning your local mechanic can fix a leak or replace a valve without needing a degree in computer science.

However, this simplicity means the machine won’t “protect itself” as well as a computer-controlled robot. This shifts the responsibility to your maintenance team. You cannot skip intervals. To get the same lifespan out of these trucks, you must enforce a rigorous servicing plan for underground mining trucks. If you treat them rough without grease, they will fail faster than a CAT.

ROI Analysis: The “Standby Unit” Strategy

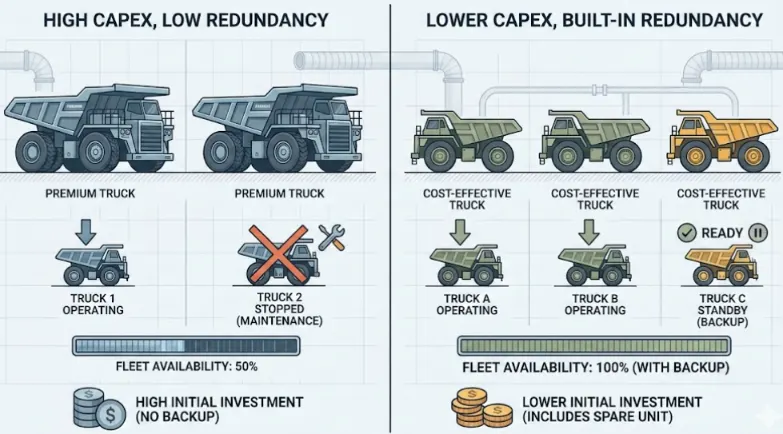

Let’s talk money. The strongest argument for switching isn’t just the purchase price; it is fleet redundancy.

Imagine you have a budget of roughly $1.5 – $2 million for a 20-tonne hauling fleet.

- Option A: You buy 2 used or 1.5 new premium trucks. If one breaks down, your production gets cut in half.

- Option B: You buy 3 new ZONGDA 20-ton trucks. You run two and keep one on standby.

In Option B, even if the Chinese truck has a shorter total lifespan, your daily availability is higher because you have a spare machine ready to go. For short-to-medium term mining projects (3-7 years) in 4.5m x 4.5m headings, the Return on Investment (ROI) often favors the lower-cost fleet.

Addressing the Risks: What You Sacrifice

We need to be honest here. You do not get a luxury experience for a budget price. When you inspect underground mining vehicles from China, you will notice the difference in fit and finish.

The paint might scratch easier. The cabin noise levels might be slightly higher. The operator seat might be functional rather than ergonomic perfection. Additionally, mining equipment manufacturers in china generally do not have a service center in every province or state. You are taking on more responsibility for holding stock of filters, seals, and hoses on-site.

But ask yourself: does the ore care if the dashboard is made of hard plastic? Does the rock pay extra for a touchscreen display? If your priority is tonnage moved per dollar spent, these cosmetic trade-offs are often irrelevant.

Conclusion: Making the Right Choice

If you are running a Tier-1 super mine with a 20-year life of mine and strict autonomous requirements, stick with Sandvik or Epiroc. They are the best for a reason.

However, if you are a contract miner, a junior mining company, or operating in a remote location where mechanics are more common than laptops, the math changes. By choosing a truck that uses the same Kessler axles and DANA transmission as the big guys, but without the brand markup, you can significantly lower your operating costs. The key is to look past the logo and check the specs.

Manufacturer Spotlight: Qingdao ZONGDA Machinery

One company that has aggressively targeted this gap in the market is Qingdao ZONGDA Machinery Co., Ltd. Unlike generalist trading houses, ZONGDA is a specialized manufacturer dedicated exclusively to underground metal ore mining—specifically for Gold, Copper, Iron, and Lead-Zinc operations.

Based in Qingdao, the company focuses on delivering robust solutions like the 20-ton Underground Truck. Engineered for tunnels 4.5m x 4.5m and larger, this machine combines the brute force of a Deutz V12 engine (or optional Volvo) with the precision of a DANA R36000 transmission. Their strategy is simple: bridge the gap between cost and quality by integrating world-class components into a rugged, uncomplicated chassis. For international clients, ZONGDA provides a pragmatic fleet option that balances upfront CapEx savings with the operational uptime required in remote hard-rock environments.

FAQ

Q1: Do these trucks really use genuine Kessler axles and DANA transmissions?

A: Yes, they are genuine. ZONGDA integrates German Kessler axles and US-designed DANA R36000 transmissions directly into the chassis. The part numbers are standard global codes, meaning you can verify them and even order internal replacement parts from your local European or American distributors if needed.

Q2: How long is the lead time compared to CAT or Sandvik?

A: This is usually the biggest selling point. While big brands might quote you 12 months, ZONGDA can typically have a standard 20-ton model ready for shipment in 30 to 60 days.

Q3: Can I get spare parts easily if I am in South America or Africa?

A: Yes, but with a strategy. For the engine (Deutz/Volvo) and drivetrain (Dana/Kessler), parts are available globally, locally. For structural parts (cylinders, pins, bushings), ZONGDA usually ships a “First Aid Kit” of spare parts with the machine, and they can air-freight specific components when needed.

Q4: Is the Deutz engine better than the Volvo option?

A: It depends on your mine. The Deutz F12L413FW is air-cooled, meaning it has no radiator to leak or overheat, which is brilliant for hot, deep mines. The Volvo TAD853VE is water-cooled, quieter, and more fuel-efficient, but requires more careful maintenance of the cooling system. ZONGDA offers both.

Q5: What is the warranty policy?

A: Typically, it is 2000 hours or one year, whichever comes first. However, the real warranty is the simplicity of the design—there are fewer proprietary electronic “black boxes” that can fail and leave you stranded.